Life Insurance in and around Houston

Get insured for what matters to you

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

When it comes to high-quality life insurance, you have plenty of choices. Evaluating coverage options, providers, riders… it’s a lot, to say the least. But with State Farm, you won’t have to sort it out alone. State Farm Agent Jerrad Ragsdell is a person who is passionate about helping you set you up with a plan for your specific situation. You’ll have a no-nonsense experience to get cost-effective coverage for all your life insurance needs.

Get insured for what matters to you

Don't delay your search for Life insurance

Agent Jerrad Ragsdell, At Your Service

When opting for your Life insurance coverage, it's helpful to know the factors that play into the type and amount of Life insurance you need. These tend to be things like the age you are now, your health status, and perhaps even body weight and family medical history. With State Farm agent Jerrad Ragsdell, you can be sure to get personalized service depending on your individual situation and needs.

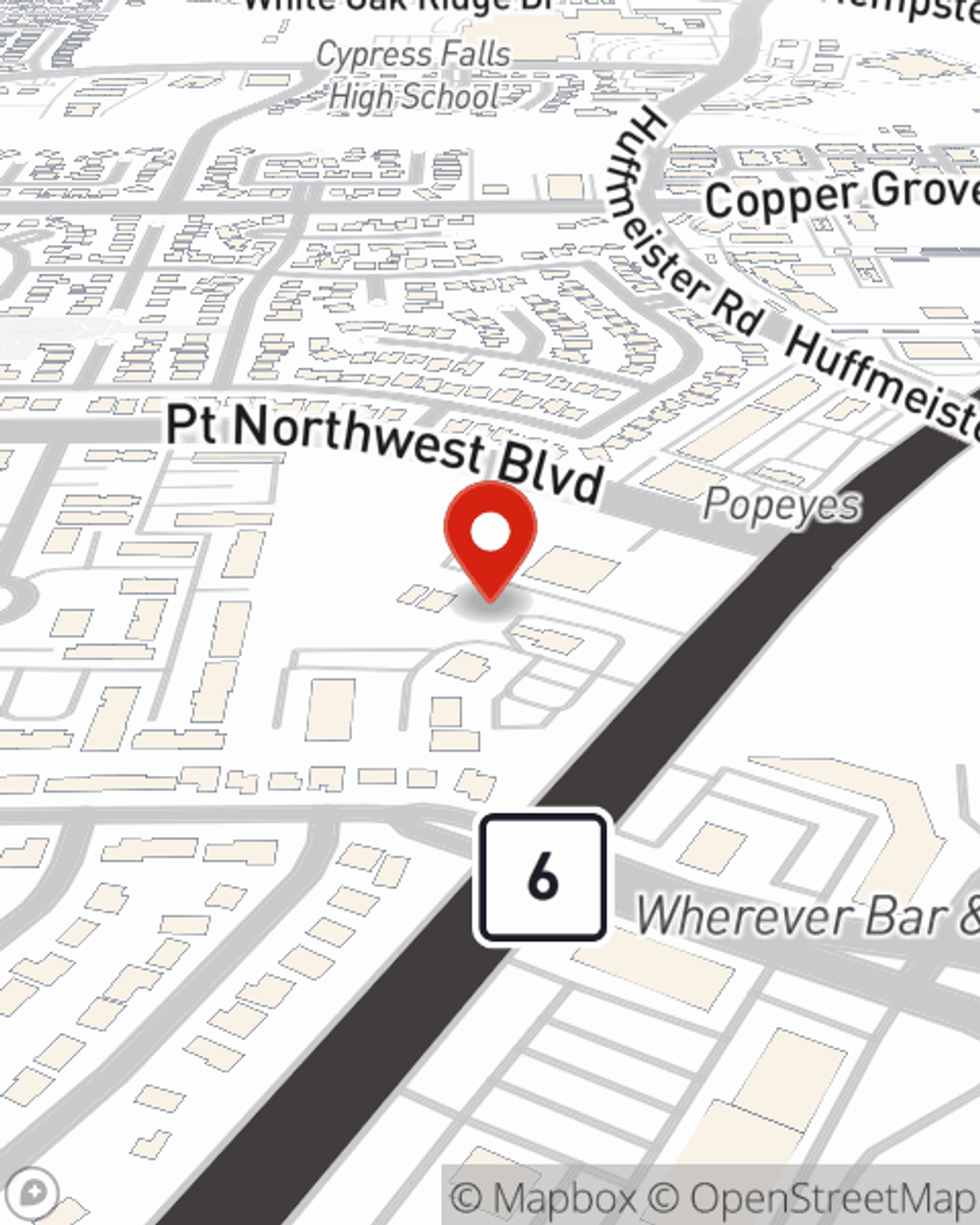

It's always a good time to make sure your loved ones have coverage against the unexpected. Visit Jerrad Ragsdell's office to discover how State Farm can help cover your loved ones.

Have More Questions About Life Insurance?

Call Jerrad at (281) 861-8800 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Jerrad Ragsdell

State Farm® Insurance AgentSimple Insights®

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.